Continental Re, Ghana Re to intensify insurance training in sub-region.

The Chief Operating Officer of Continental Reinsurance Company in charge of Anglophone West Africa, Shola Ajibade has pledged to strengthen the mutual co-operation that exist between his outfit and Ghana Re.

The two reinsurers made the pledge at a training programme held at the Volta Serene Hotel, Ho from 1st -7th Septemeber 2019. The event was the fourth in a series of international annual trainings being held by the two reinsurance companies since 2016.

According to him, insurance companies, reinsurance brokers should endeavour to send their staff for regular training programmes in order to make them acquire practical knowledge.

He also pointed out that Continental Re has opened offices in most of the regions of Africa including Cameroon to cater for the Francophone countries in the Central Africa likewise Ghana Re.

Furthermore, offices have also been established in Kenya for the East African bloc to service insurers in that part of the continent and Southern Africa. He added that the two companies were committed to giving practical training to insurance and brokerage companies operating in the Anglophone West Africa.

In all, about 59 insurance and brokerage professionals accross the sub region attended the joint seminar on reinsurance pricing. The participants came from Ghana, Nigeria and Botswana and Sierra Leone.

The resource persons were from Ghana and Nigeria. They include Jonathan Kwame Kwakye, Kwaku Appietu-Ankrah both from Ghana Re, with Shola Ajibade and Gbolahan Toru of Continental Re from Nigeria.

The participants were taken through introduction to reinsurance, global strength on pricing of reinsurance programme (facultative), design of reinsurance programme (non-proportional).

These topics were handled on day one by Jonathan Kwame Kwakye, Shola Ajibade and Kwaku Appietu-Ankrah. The second day brought in Kwaku Appietu-Ankrah, Shola Ajibade and Gbolahan Toru.

Whist reinsurance data mechanism (data analysis) pricing of reinsurance programme non-proportional came up on the third day with Gbolahan Toru and Jonathan Kwame Kwakye handling contract documentation (operative clause) and contract documentation (accounting clause) on the last day. The event was then climaxed with an excursion to Wli waterfalls and monkey sanctuary on Friday.

Disclaimer: "The views expressed on this site are those of the contributors or columnists, and do not necessarily reflect insureghana's position. insureghana.com will not be responsible or liable for any inaccurate or incorrect statements in the contributions or columns here."

Share On Social Media

Other Posts

The insurance price war in Ghana: an overview and proposed solutions

Ghana Re’s 19th international insurance seminar opens

Why Ghanaians should consider the Home/Office 360 Insurance Policy

Dr. Abiba Zakariah appointed as new Commissioner of NIC

President of Ghana Insurers Association, Seth Aklasi appointed Ag. MD of Ghana Reinsurance Company

Empowering Your Business with M-Broker Software

New CIMG president targets membership increases as part of Agenda 5/5 initiative

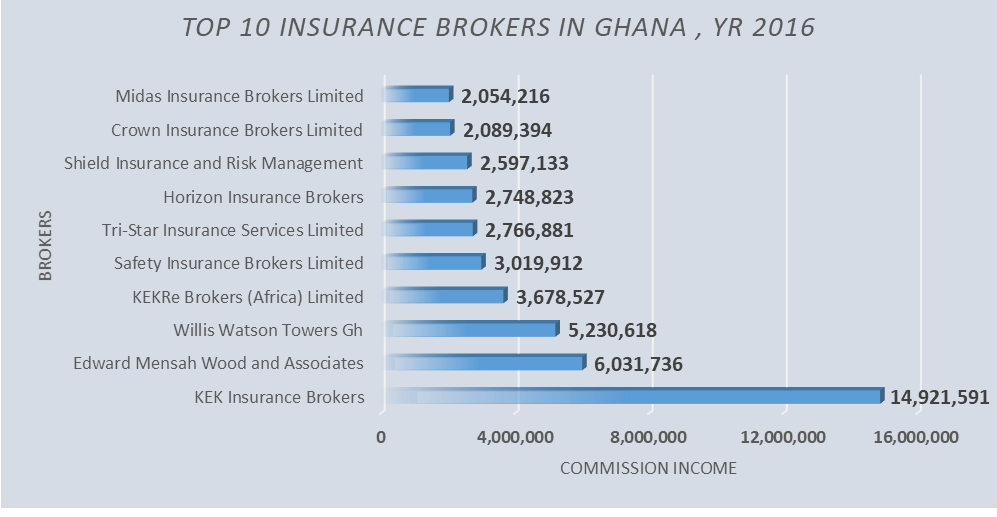

Edward Mensah Wood & Associates, Leading Insurance Broker in Ghana and Sub Regions

miTribute – for Funeral Expenses of a death of a family member or otherwise

How to Ensure Your Family’s Financial Security with Individual Life Insurance

InsureTech

Technology