Ghana Insurance College to train 10,000 agents

The National Insurance Commission (NIC) through the Ghana Insurance College (GIC) is in the process of training 10,000 youth as Insurance Sales Agents as an agendum for job creation to ultimately lead to an increase in the insurance penetration rate currently is under 2%.

This was disclosed by the Director of the GIC, Richard Okyere, in his state of the College address during the 12th Convocation Dinner and Awards Ceremony of the College last week.

He expressed delight by the fact that the College has since the beginning of this year, started a capacity building training programme for existing Insurance Sales Agents of all Insurance Companies across the country which has the objective of equipping them to engage the insuring public in a more professional and ethical manner - a distinctive training module that integrates practice and ethics of the insurance trade.

He also used the opportunity to thank all key stakeholders for their continuous support for the development of human capital and the growth of the industry.

A Member of the Council of State and the immediate former Chief Justice, Mrs Justice Georgina Theodora Wood, who was the Guest Speaker, challenged the graduands to demonstrate professionalism.

“Remember that you have been trained to achieve the quality of excellence that would lead to sustainable industry growth. Obviously, the Ghanaian people would like to see responsible insurance professionals imbued with a high sense of integrity, fairness, faithfulness, transparency and diligence,’ she admonished.

She also proposed that the College should incorporate Dispute Resolution into its programmes as the “lack of good negotiation and other Alternative Dispute Resolution (ADR) skills among practitioners have the tendency of impeding amenable settlement of insurance cases out of court” as “there is an urgent need to strategise to find ways of reducing insurance related litigation in our already overburdened courts.”

In his remarks, the Commissioner of Insurance, Justice Yaw Ofori, intimated that a vibrant insurance industry depended largely on the development of its human capital needs hence, the role of the GIC as a stop gap in this regard.

He also called on graduands to be disciplined in their chosen career pursuits and that achieving academic and professional excellence in one’s career can only be guaranteed through unmatched integrity.

Students who stood out in various modules during the academic year were recognised and presented with special awards with the Overall Best Student prize going to Mr Fred Mensah Sarpong.

Some 92 students graduated with diplomas and certificates awarded jointly by the GIC and the Malta International Training Centre (MITC), Malta.

The GIC is the country’s premier professional training institution for insurance professionals and has since its establishment in 2006 produced close to 300 Chartered Insurers (Associates) under the UK-based Chartered Insurance Institute (CII-UK).

The GIC has a mission ‘to train, develop and mentor insurance professionals to excel in the practice of insurance profession’. Its principal stakeholders are the NIC, the Ghana Insurers Association (GIA), the Ghana Insurance Brokers Association (GIBA) and the Chartered Insurance Institute, Ghana (CIIG).

Source: Ghana | Myjoyonline.com | JTM

Disclaimer: "The views expressed on this site are those of the contributors or columnists, and do not necessarily reflect insureghana's position. insureghana.com will not be responsible or liable for any inaccurate or incorrect statements in the contributions or columns here."

Share On Social Media

Other Posts

The insurance price war in Ghana: an overview and proposed solutions

Ghana Re’s 19th international insurance seminar opens

Why Ghanaians should consider the Home/Office 360 Insurance Policy

Dr. Abiba Zakariah appointed as new Commissioner of NIC

President of Ghana Insurers Association, Seth Aklasi appointed Ag. MD of Ghana Reinsurance Company

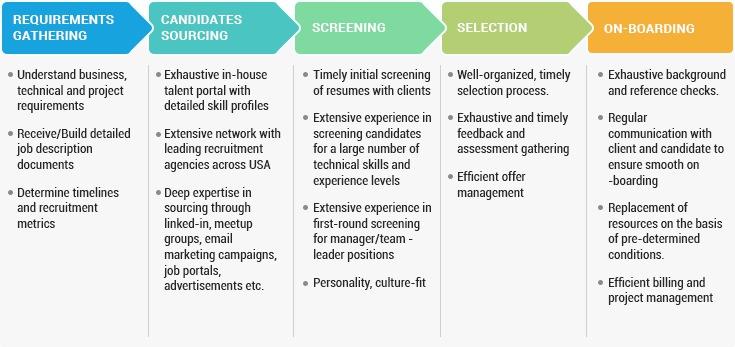

Empowering Your Business with M-Broker Software

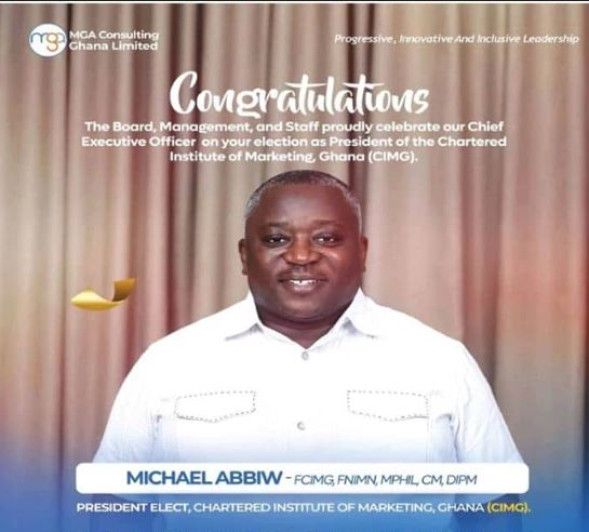

New CIMG president targets membership increases as part of Agenda 5/5 initiative

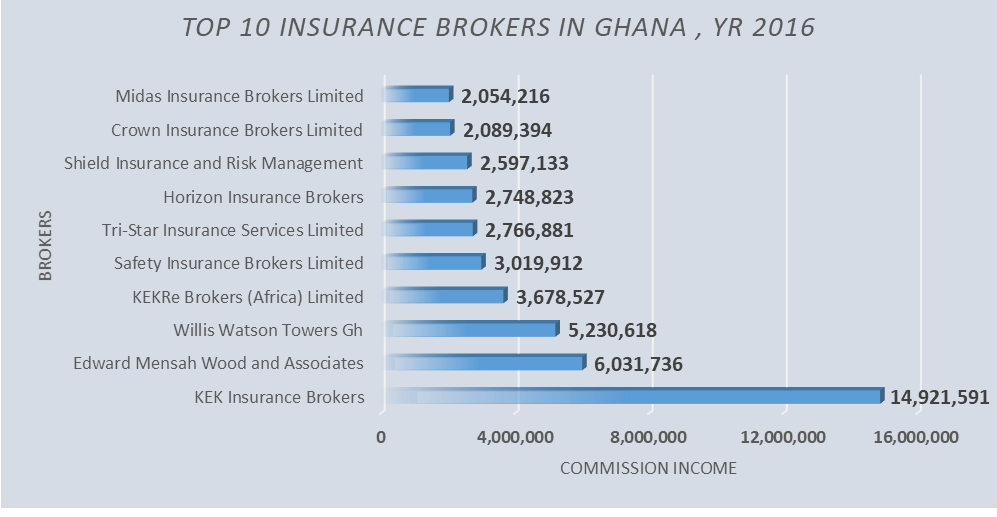

Edward Mensah Wood & Associates, Leading Insurance Broker in Ghana and Sub Regions

miTribute – for Funeral Expenses of a death of a family member or otherwise

How to Ensure Your Family’s Financial Security with Individual Life Insurance

InsureTech

Technology