High-rise Buildings To Attract Compulsory Insurance- NIC

5 February, 2019

High-rise buildings in the country will soon attract compulsory insurance cover, the Commissioner of the National Insurance Commission (NIC) has said.

Justice Yaw Ofori said, “Now we have high-rise buildings coming up in Ghana, everybody goes and he buys his unit but there should be insurance for every unit owner and there should be insurance for the whole building because if one unit owner’s unit gets burnt, it can affect the whole building but people don’t see it that way.

”He said, “We want that to be compulsory so that when you have a unit within an apartment building if the apartment building comes down because of the negligence of someone, you have some protection.”The Commissioner says it seeks to forward a bill to parliament before the end of this year to seek government’s buy-in.

Mr Ofori said, “We are reviewing our Act so we are working on the bill right now.”He added, “We are going to incorporate additional policies; insurance for apartments and condominiums so that it becomes law.”As part of its resolve to expand the basket of compulsory insurances, the Commission has identified living in high-rise apartments as a risky venture.

The construction of high-rise buildings in the country is fast catching on. As a result, the Ministry of Works and Housing, last year, hinted that it was working hard to forward a bill parliament which seeks to regulate condominiums in the country.

According to the Sector Minister, Samuel Atta-Akyea, the bill if passed would spell out rules and regulations governing the construction and siting of such high-rise buildings in the country.Other compulsory insurancesCurrently, Ghana’s insurance companies underwrite two compulsory insurance policies.

That is, the Motor Third-Party policy and the Fire policy (for Private Commercial Properties).But the Commissioner has hinted that it seeks to widen the mandatory insurance net to include others like Workmen’s Compensation, Group Life insurance, among others.

Disclaimer: "The views expressed on this site are those of the contributors or columnists, and do not necessarily reflect insureghana's position.

insureghana.com will not be responsible or liable for any inaccurate or incorrect statements in the contributions or columns here."

Other Posts

The insurance price war in Ghana: an overview and proposed solutions

Ghana Re’s 19th international insurance seminar opens

Why Ghanaians should consider the Home/Office 360 Insurance Policy

Dr. Abiba Zakariah appointed as new Commissioner of NIC

President of Ghana Insurers Association, Seth Aklasi appointed Ag. MD of Ghana Reinsurance Company

Empowering Your Business with M-Broker Software

New CIMG president targets membership increases as part of Agenda 5/5 initiative

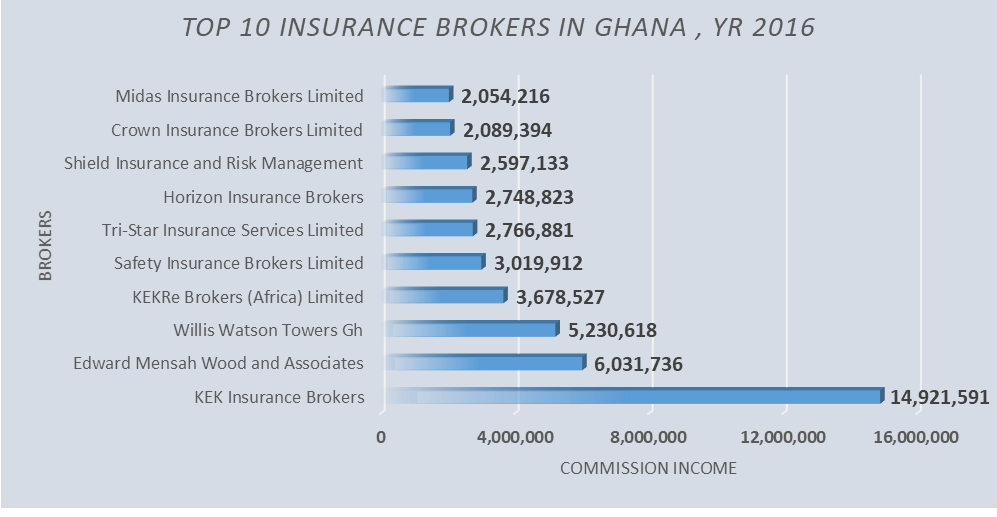

Edward Mensah Wood & Associates, Leading Insurance Broker in Ghana and Sub Regions

miTribute – for Funeral Expenses of a death of a family member or otherwise

How to Ensure Your Family’s Financial Security with Individual Life Insurance

Insurance Commission advances digital transformation agenda

Read More

Embracing Digital Transformation to Serve Future Insurance Customers

Read More

Digital Transformation Guidelines for Insurance Brokers in Ghana

Read More

Emerging Trends In Ghanaian Insurance Market An Overview

Read More

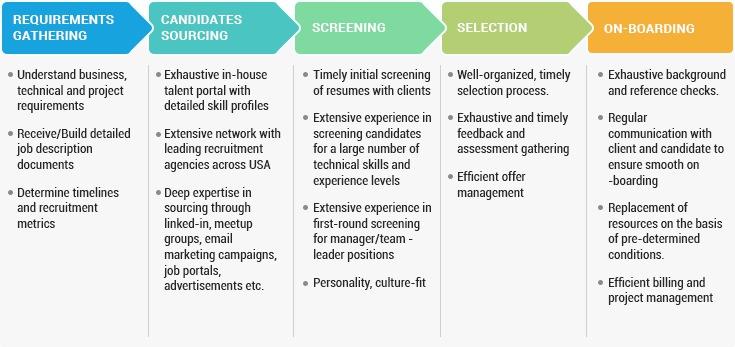

What Your Insurance Broker Should Do For You

Read More

7 Signs Of Unethical Insurance Broker

Read More