The Ghana Revenue Authority (GRA) has announced that, effective 1st April 2025, all non-life insurance products (excluding motor insurance) will attract Value Added Tax (VAT) and applicable levies under the Value Added Tax (Amendment) Act 2023 (Act 1107).

BREAKDOWN OF THE APPLICABLE TAXES

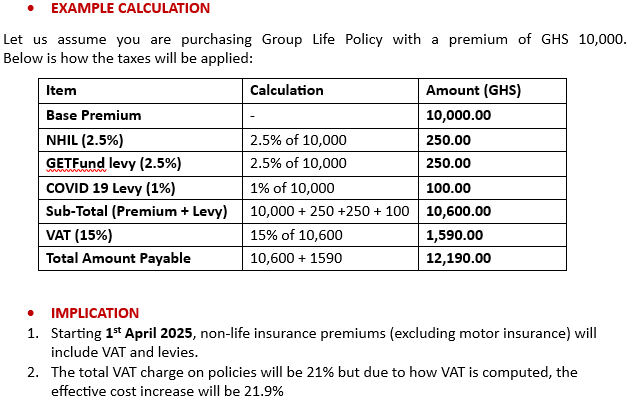

The total VAT rate applied to non-life insurance services is 21%. However, due the method of calculating VAT, the effective rate will be 21.9%. Here’s how it is determined:

National Health Insurance Levy (NHIL) – 2.5% (applied before VAT)

GETFund Levy – 2.5% (applied before VAT)

🌍 Need tailored insurance coverage?. Whether it is marine, motor, or property?. Get a free quote at Safeguard Insurance Brokers.

COVID 19 Levy – 1% (applied before VAT)

VAT – 15% (calculated on the sum of the insurance premium + NHIL + GETFund + COVID 19 Levy)

We understand that this is a significant change and we remain committed to keeping you informed and ensuring smooth transition.

If you have any further questions or need any further clarification, please feel free to contact Mr. Stephen Kwarteng, MD of OLEA M&G Insurance Brokers for all your insurance needs.

Stephen Kwarteng Yeboah is a seasoned Chartered Insurer, Chartered Accountant, and Risk Management Expert with 19+ years of experience in the insurance industry.

Managing Director – OLEA M&G Insurance Brokers Ltd

Vice President – Insurance Brokers Association of Ghana (IBAG)

💼 Partner with InsureGhana to grow your insurance business. Learn More

Contact: +233 (0)302-254 647 / +233 (0)302-254 649

Email: contactghana@olea.africa /f.oppong@oleaafrica

Website: www.oleamgbrokers.com

🟡 Need vehicle insurance? Compare quotes from top insurers. Contact us at. Safeguard Insurance Brokers

Disclaimer: "The views expressed on this site are those of the contributors or columnists, and do not necessarily reflect insureghana's position. insureghana.com will not be responsible or liable for any inaccurate or incorrect statements in the contributions or columns here."

InsureGhana Research Desk

Providing independent intelligence and guidance for brokers across West Africa.

Related News

NIC Warns Public Against Transacting with Unlicensed Insurance Brokers in Ghana

The National Insurance Commission (NIC) has issued public notices cautio...

Choosing the Best Health Insurance: A Customer-Focused Guide

Why Choosing the Right Health Insurance Matters? Health insurance is no...

Insurance Ecosystem: A Sustainable Approach to Premium Financing

By John Baffour Awuah Barnes (ACIIG, ACIM-UK) The world stands at a pivotal...

Need tailored insurance coverage?

Whether it's marine, motor, or property, our brokers can help you get the best quote in minutes.

Get a Free Quote →