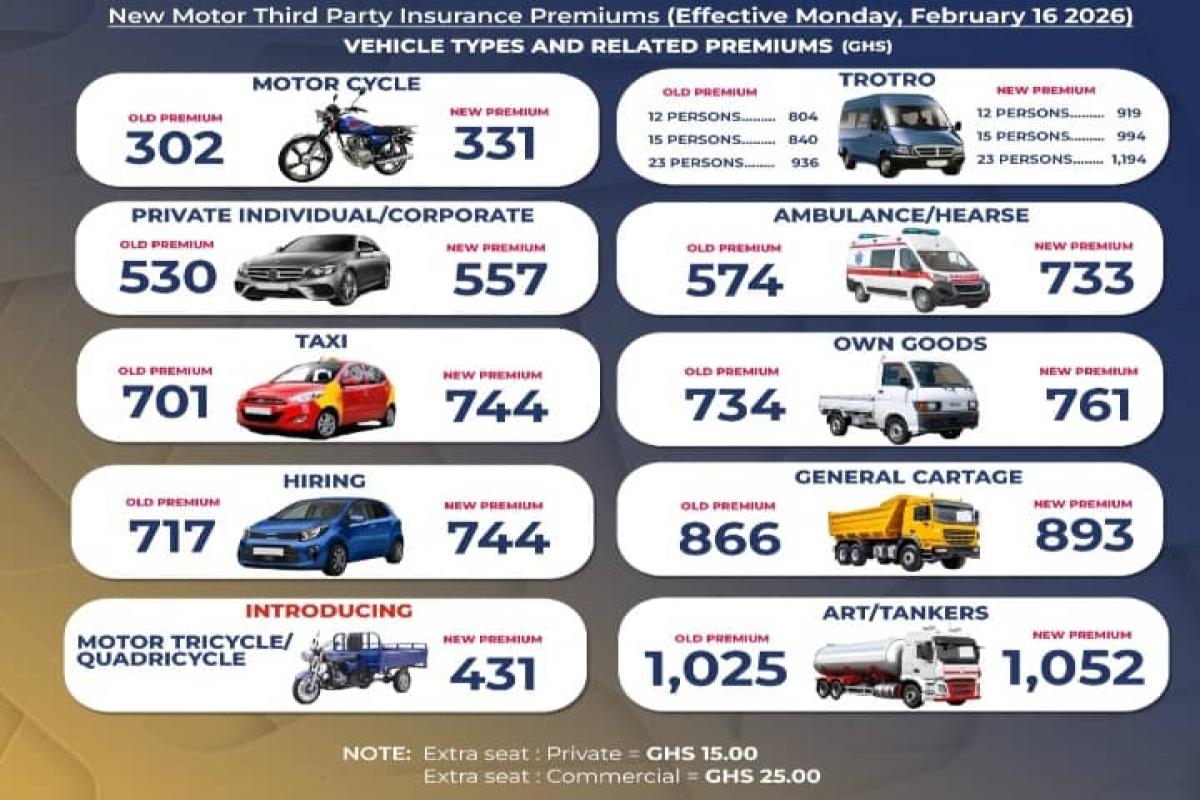

Motorists across Ghana are being advised of new Motor Third Party Insurance premium rates taking effect from Monday, 16 February 2026.

The revised rates apply to various vehicle categories, including private cars, commercial vehicles, taxis, trucks, and motorcycles. Consumers are encouraged to take note of the changes when renewing or purchasing policies.

Updated Premium Highlights (GHS)

-

Motor Cycle: from 302 to 331

-

Private Individual/Corporate: from 530 to 557

-

Taxi: from 701 to 744

🌍 Need tailored insurance coverage?. Whether it is marine, motor, or property?. Get a free quote at Safeguard Insurance Brokers.

-

Hiring: from 717 to 744

-

Ambulance/Hearse: from 574 to 733

-

Own Goods: from 734 to 761

-

General Cartage: from 866 to 893

-

Articulated/Tankers: from 1,025 to 1,052

💼 Partner with InsureGhana to grow your insurance business. Learn More

Commercial Passenger Vehicles (Trotro)

-

12 Persons: from 804 to 919

-

15 Persons: from 840 to 894

-

23 Persons: from 936 to 1,194

New Category Introduced

-

Motor Tricycle/Quadricycle: 431

Additional Charges

-

Extra Seat (Private): GHS 15.00 per seat

🟡 Need vehicle insurance? Compare quotes from top insurers. Contact us at. Safeguard Insurance Brokers

-

Extra Seat (Commercial): GHS 25.00 per seat

What Consumers Should Know

Motor Third Party Insurance is mandatory under Ghanaian law and provides compensation for injury, death, or property damage caused to third parties in the event of an accident.

Vehicle owners with policies expiring on or after 16 February 2026 should budget according to the new rates. Consumers are encouraged to:

-

Confirm renewal premiums with their insurers or brokers

-

Avoid roadside or unauthorized insurance vendors

🌍 Explore reinsurance insights and trends across West Africa at InsureGhana Insights.

-

Ensure policies are properly issued and verifiable

For further clarification, motorists may contact their licensed insurance company or broker.

InsureGhana.com will continue to provide updates affecting policyholders and the general public.

Cick Link Below to Shop for Insurance

Disclaimer: "The views expressed on this site are those of the contributors or columnists, and do not necessarily reflect insureghana's position. insureghana.com will not be responsible or liable for any inaccurate or incorrect statements in the contributions or columns here."

Insight

Expert insights and data-driven analysis from Ghana’s leading insurance knowledge hub