Ghana's insurance industry penetration lags at a mere 1.4% of GDP compared to 2.8% in Kenya and 17% in South Africa—owing to limited awareness, high premium costs, and distrust of insurance providers.

With the advent of mobile banking and transactions, stakeholders are recommending the potential of a synergy between insurance and telecom companies to reach wider populations, especially the informal sector.

Targeting the country’s vast informal sector, which constitutes about 80% of the workforce, the mobile-driven insurance solution will provide affordable protection against death, disease, and disability.

A UNDP report reveals that despite Ghana's favourable environment for insurance, about 70% of Ghanaians do not have access to any form of insurance.

A large portion of the uninsured population is in the informal sector.

🌍 Need tailored insurance coverage?. Whether it is marine, motor, or property?. Conact us at ARB Insurance Brokers.

Access and convenient channels remain some of the biggest setbacks influencing these slow penetration levels of insurance.

As the usage and adoption of mobile banking and trading surge, collaboration has become essential to propel financial inclusion, business and life protection.

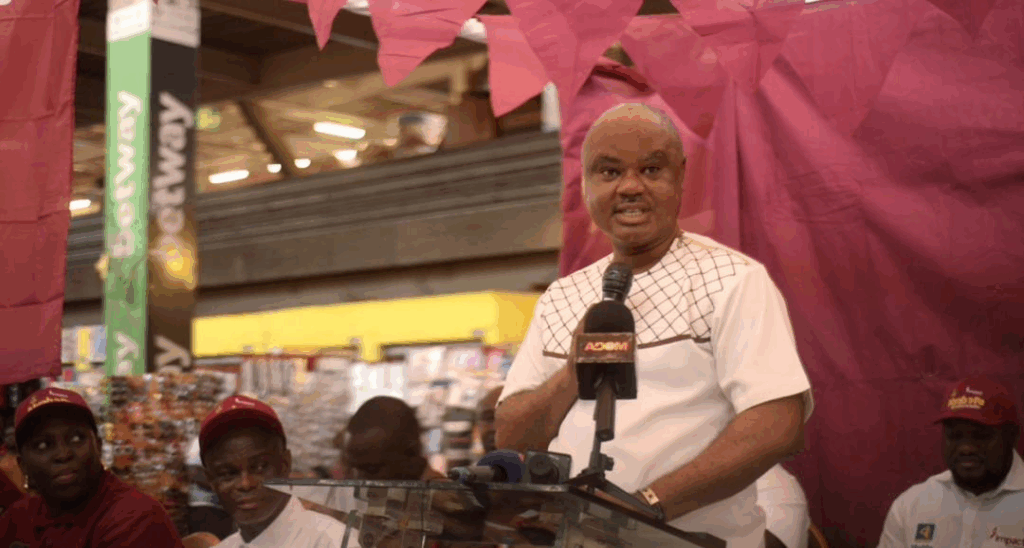

Chief Executive Officer of Impact Life Insurance Limited, Sheriff Abudu, says getting insurance protection is the need of the hour.

“As new viruses and diseases emerge, resulting in loss of health and life, protecting oneself and the family against such unforeseen scenarios has become even more imperative.

💼 Partner with InsureGhana to grow your insurance business. Learn More

“The leverages on Mobile Money platforms will make insurance accessible, ease financial burdens and drive financial inclusion and economic resilience across Ghana. Partnering with the informal sector will widen the prospects bracket, our scope and improve the insurance penetration levels in Ghana,’’ he said.

Sheriff Abudu spoke on the sidelines of a collaboration between Impact Life Insurance and MTN Mobile Money (strategically supported by CoreNett) that launched the ‘Abrabopa’ product to provide affordable mobile insurance services to the informal sector.

“For just GHS2.40 monthly, Abrabopa offers comprehensive life and health coverage, protecting against death, disease, and disability. For us at Impact, a new chapter is about to begin as we are inspired by the butterfly effect, the idea that a little change can cause a ripple effect to make larger differences in a later state,” he said.

The product aims to reduce the financial burden on families, assist families during funerals and provide benefits for critical illnesses like kidney failure, heart attack, major organ transplants and major burns.

🌍 Explore reinsurance insights and trends across West Africa at InsureGhana Insights.

MTN Northern Sector Momo Channel Development Manager, Akwasi Kwarteng, indicates the collaboration will open opportunities for financial growth.

“We are committed to improving lives by expanding access to essential financial services and insurance is a critical part of the vision. Abrabopa is designed for everyday Ghanaians to be simple, affordable and directly accessible through the Momo platform. In combining our expansive reach of 17 million active users with Impact Life expertise, we are unlocking new possibilities of financial resilience across the country,” he said.

About 18 life insurance companies are actively operating in Ghana as at 2023.

Ashanti regional manager of the National Insurance Commission, Faruk Dramani, is admonishing customers to be confident and trust insurance services in the country.

He commended Impact Life Insurance for becoming a notable name in the insurance landscape of Ghana.

🟡 Need vehicle insurance? Compare quotes from top insurers. Contact us at. ARB Insurance Brokers

“There is an erroneous impression that insurance companies do not pay claims. But our data shows that 510 million cedis daily is paid by life insurance companies to policyholders. Customers have confidence in insurance. It's good news that Impact Life is adding to the list. Out of the 18 life insurance policies we have, Impact Life Insurance is in the top 8,” he said.

Chief Operations Officer of Impact Life Insurance, Sylvester Acheampong, outlined details of the Abrabopa insurance policy.

“The policy covers the main life (policyholder), biological parents and parents-in-law. Onboard on *170# on MTN, financial services, then insurance, then Impact Life. You’d be instantly covered. Our claims processing (Submit via USSD) includes a death certificate, medical report and Ghana card,” he said.

The launch assembled emergency service providers, market folks and insurance enthusiasts.

The National Insurance Commission (NIC) raised the minimum capital from GHS15m to GHS50m which left many life insurance companies with intractable challenges and uncertainties about how to raise the additional capital.

In February 2022, Uhuru Capital Partners, a Private Equity Firm based in Luxembourg, with over USD 115 million in investable capital, received approval from the NIC to merge Phoenix Life Assurance Company with Ghana Union Assurance Life Company Limited (GUA Life), the first merger of life insurance companies in Ghana.

The new entity brings in its wake a combined experience of 31 years in operations.

This merger birthed Impact Life Insurance Limited Company, an unprecedented company that will undoubtedly transform the sector with relentless creativity and innovation.

Disclaimer: "The views expressed on this site are those of the contributors or columnists, and do not necessarily reflect insureghana's position. insureghana.com will not be responsible or liable for any inaccurate or incorrect statements in the contributions or columns here."

InsureGhana Research Desk

Providing independent intelligence and guidance for brokers across West Africa.

Related News

Understanding Motor Vehicle Insurance in Ghana: Types, Benefits, and What to Do When a Claim Occurs

Understanding Motor Vehicle Insurance in Ghana: Types, Benefits, and What to Do...

Liberia: Establishing an Independent Regulator and Financial Integrity

The insurance sector in Liberia is on the brink of a crucial transformation, shi...

Zero tariffs doesn’t mean open floodgates for cheap goods – Prof Quartey tells gov’t

“We have to regulate and ensure that all products meet the necessary standard pr...

Need tailored insurance coverage?

Whether it's marine, motor, or property, our brokers can help you get the best quote in minutes.

Get a Free Quote →